FUTURE,

IN YOUR

PORTFOLIO.

The region's first multi-asset class

fund to incorporate Bitcoin.

Bringing traditional and digital assets

together in a professionally managed,

easily accessible fund.

BITMAC

Bitcoin and Multi-Asset Class Fund

ONE DISCIPLINED PORTFOLIO

MIDDLE EAST'S FIRST

MULTI-ASSET CLASS

FUND TO INCORPORATE

BITCOIN.

BITMAC will maintain an allocation of 90 percent across global equities and global fixed income, 5 percent in gold, and 5 percent in Bitcoin. Designed to enhance portfolio resilience and provide diversified growth potential. All managed within a DIFC-domiciled, DFSA-regulated fund-of-funds structure.

*Allocations to equities and fixed income are approximate and are subject to change.

Investor Benefits

What's in it for you

Discover how BITMAC's unique multi-asset approach delivers value for investors

Lower Overall Risk

While individual assets can be volatile, combining them strategically reduces portfolio risk.

Enhanced Returns

Bitcoin and Gold allocation can potentially boost performance when combined with traditional portfolios.

Market Resilience

Diversified asset mix can provide better protection during market downturns.

Systematic Rebalancing

Asset allocation with quarterly rebalancing systematically buys lower priced assets and sells higher priced ones.

INVESTMENT

WHY CHOOSE BITMAC

A multi-asset fund for the future, that professionally allocates to traditional and digital assets in one portfolio.

EACH INDIVIDUAL ASSET CAN BE RISKY.

BUT COMBINING THEM GIVES ACCESS WITH LOWER OVERALL RISK

Back tested risk comparison 180 volatility

... WHILE CAPTURING HIGHER RETURNS

By adding Bitcoin and Gold to equity and fixed income, BITMAC could enhance the performance versus a balanced or equity only portfolio.

Back tested average return (CAGR)

... AND COULD PROVIDE RESILIENCE

DURING MARKET DOWNTURNS

Back test shows that BITMAC will have had similar resilience to the balanced portfolio and better than the global equity portfolio.

Back tested maximum drawdown during market downturns (%)

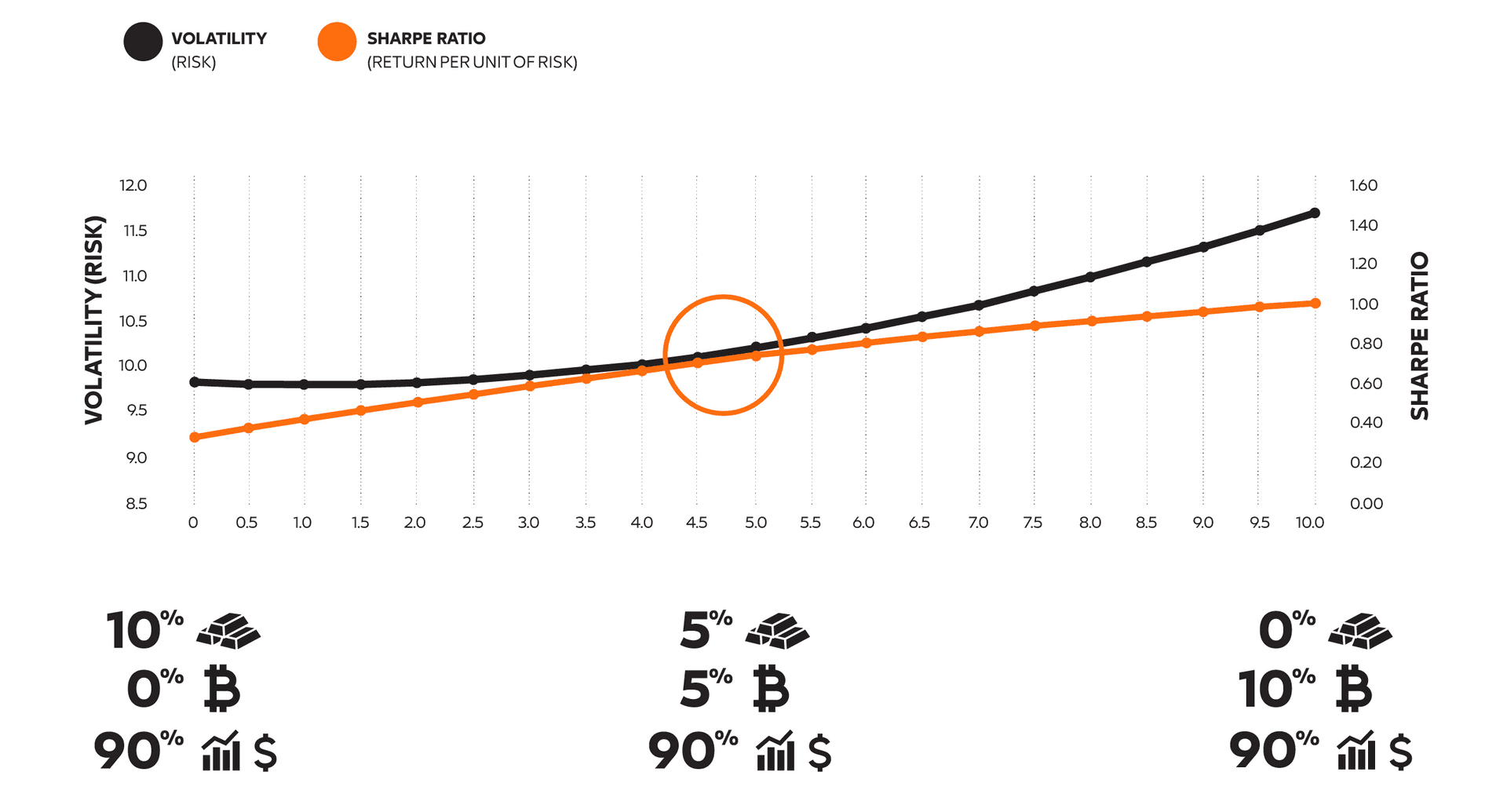

OPTIMALLY BALANCED

SYSTEMATICALLY REBALANCED.

With an optimal asset allocation the portfolio systematically buys lower priced assets and sells higher priced ones.

Finding the optimal mix for Gold and Bitcoin

Source 1 [Graph 1-3]: Mashreq Capital, Bloomberg, Data as of 30 September 2025

Source 2 [Graph 4]: Mashreq Capital, Bloomberg, Data is from the period from 30 September, 2015 to 30 September, 2025

Disclaimer: ALL BITMAC figures represent BACKTESTED DATA.

MEET OUR DISTRIBUTOR

READY TO INVEST

IN THE FUTURE?

One professionally managed fund combining Bitcoin, gold, and global equities - designed for the next decade of investing.

Login on the link below (It will take you directly to Mutual Funds page)

Complete the one-time setup for investment account (only for clients who haven't invested with Mashreq before)

Enter "BITMAC" into the search bar to see all the available details

Enter investment amount and Subscribe to the fund

WHY INVEST WITH